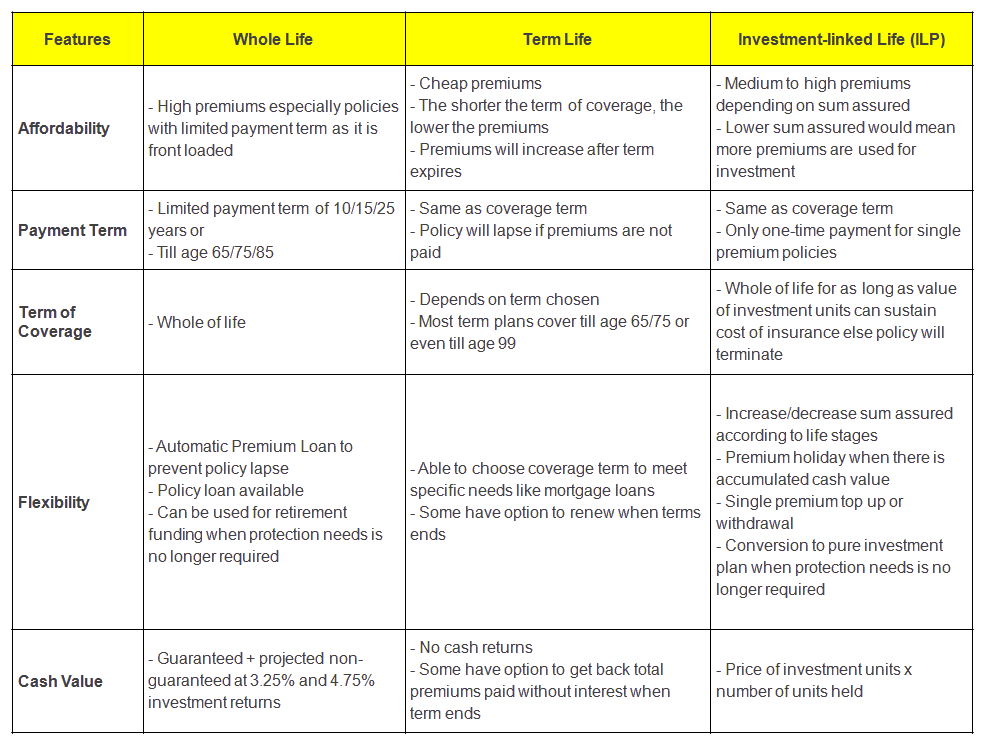

Life insurance is such a conundrum! Is that really the case? It could certainly be so given that life insurance policies come in many different variations, benefits, riders, payment and policy term etc, and you may end up not even knowing what you have bought except that you are now protected with a life insurance. To keep things simple, I will look at Life insurance at the most basic level and essentially it can be categorized into three main type of plans – Whole Life, Term Life or Investment-linked Life. Each plan has its own features and merits, so the age-old debate about Whole Life vs Term Life or that Investment-linked Life is a time bomb will not be discussed in this article. I have summarised the key features of each plan in the table below.

I hope you have a better understanding now of the different life insurance policies. There is really no best policy out of the three plans; all three will serve to protect you against death, disability and diseases. It is almost akin to buying a property. Do you want a freehold, leasehold or just a rental unit? All three will provide you with a roof over your head, but you have to ask yourself what are your objective and preference. Hence, the type of plan you should choose will be dependent on your financial and personal profile and preferences. I would personally opine that the more important question to ask first is what are your protection needs and are you adequately covered!?