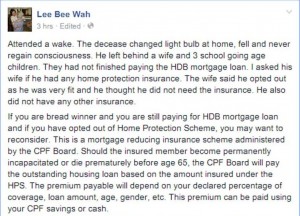

It is always very sad to read about such news. Two thoughts came to my mind after reading this news.

Home Protection Scheme (HPS) is a Cheap and Effective Mortgage Insurance. HPS is a mortgage-reducing insurance scheme to help insured members and their families pay off outstanding housing loans in the event of the insured members’ permanent incapacity or premature death before age 65. If you are taking up a HDB house loan, I would suggest not to opt out of HPS thinking that you already have a whole life insurance. HPS is the most cost effective mortgage plan in the market and it is really affordable. You can choose to pay for the premium using CPF, so no cash payment is involved. I was under HPS previously till my HDB loan was paid up. Great plan! Find out more about HPS at the following link:

(http://mycpf.cpf.gov.sg/Members/CPFSchemes/HomeProtectionScheme.htm)

Getting Yourself Insured. It is quite uncommon these days to read of someone opting not to be insured as he thinks that he is healthy and fit. I don’t think anyone of us can foresee the future. We will not know when we will be stricken by a disease or be incapacitated or even be called upon to meet the Lord early. Hence, the very basis of insurance is to manage this unknown/risk by protecting oneself against significant potential losses and financial hardship, and this is done by transferring the cost to an external entity (insurance company) at a reasonable price. It makes all the more sense for you get insured when you are healthy and fit rather than waiting till your health deteriorates before you start to panic and decide get an insurance policy. By then, you may be uninsurable or be excluded from your existing health conditions. Getting yourself insured and protected is important and all the more important if you have dependents relying on you. So for the sake of your loved ones as they will most likely be the beneficiaries not you, do seek a financial consultant early to find out how much you should get yourself adequately insured for.